In the dynamic world of finance, Contracts for Difference (CFDs) have carved a niche as a versatile trading instrument. But what exactly are what is cfds, and why should they pique your interest? Whether you’re a seasoned investor or a curious newbie, understanding CFDs can open up new trading possibilities. This article breaks down the essential features and benefits of CFDs, offering insights into why they might be a valuable addition to your investment portfolio.

Understanding the Basics of CFDs

At its core, a CFD is a financial contract between a buyer and a seller. The agreement stipulates that the seller will pay the buyer the difference between the current value of an asset and its value at the contract’s time—a potential win if the prediction is correct and a loss if not. Unlike traditional shares, CFDs allow you to speculate on price movements without owning the underlying asset. This flexibility can be particularly appealing to those looking to diversify their trading strategies.

Leverage and Margin in CFD Trading

One of the standout features of CFDs is leverage. Leverage allows traders to control larger positions with a relatively small initial deposit, known as margin. This means you can potentially amplify your returns; however, it’s important to remember that leverage can also magnify losses. Trading with leverage requires careful risk management and a clear understanding of market conditions to avoid potential pitfalls.

Access to Global Markets

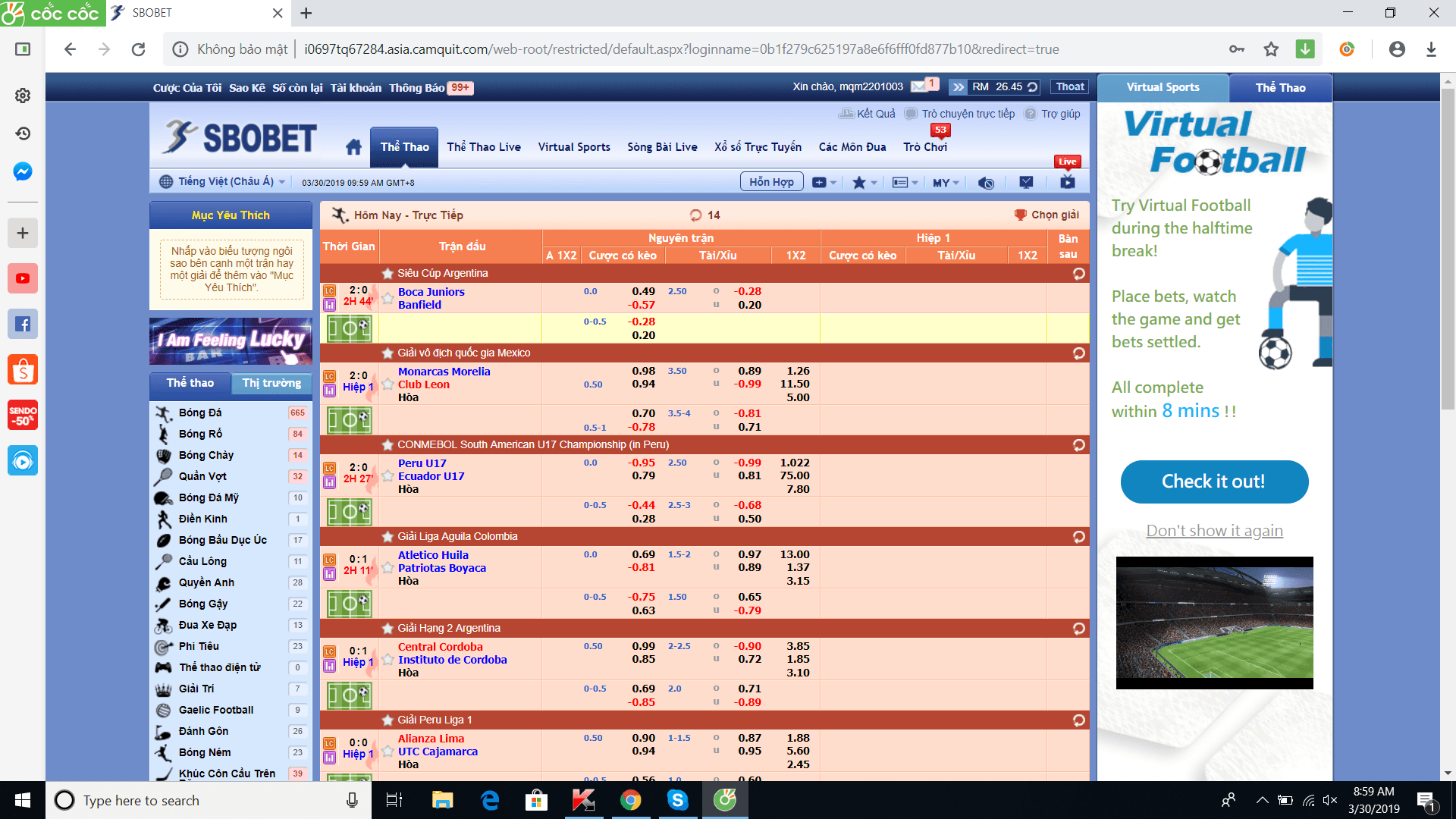

CFDs provide access to a wide array of global markets, including stocks, indices, commodities, and currencies. This wide-ranging accessibility means traders can explore numerous sectors and geographies without needing to invest in each market individually. The convenience of trading CFDs in various markets makes it easier for investors to create a diversified portfolio, tailored to their risk tolerance and investment goals.

The Flexibility of Going Long or Short

CFDs offer the flexibility to profit from both rising and falling markets. By taking a ‘long’ position, you can capitalize on anticipated price increases, while a ‘short’ position allows you to benefit from expected declines. This bidirectional approach enables traders to respond to market volatility and changing economic conditions, providing more opportunities to potentially profit from market movements.

Cost-Efficiency and No Stamp Duty

Trading CFDs often incurs fewer costs compared to traditional trading methods. There are usually no broker fees for placing trades, and in many countries, CFDs are exempt from stamp duty because ownership of the underlying assets does not transfer. This cost-effectiveness can make CFDs an attractive option for those looking to minimize trading expenses while maximizing potential returns.

Managing Risks with Stop-Loss Orders

Risk management is crucial in any form of trading, and CFDs are no exception. Stop-loss orders are a valuable tool for CFD traders, allowing them to set predetermined exit points to limit potential losses. Implementing stop-loss strategies can help traders protect their capital and maintain a disciplined approach, even in volatile markets.

In Conclusion

CFDs offer a unique combination of flexibility, leverage, and access to diverse markets, making them an appealing choice for many traders. However, like all financial instruments, they come with risks that require thorough understanding and prudent management. For those interested in exploring CFDs further, educational resources and demo accounts are often available through trading platforms, providing a risk-free environment to learn and practice. Whether you’re looking to broaden your investment horizons or seeking innovative ways to engage with global markets, CFDs present a viable option worth considering.

What Are CFDs? Key Features and Advantages Explained

Categories: